how to file taxes if you're a nanny

Mar 27 2022 How to File and Pay. Complete year-end tax forms.

Nanny Tax Do You Have To Pay Taxes For A Caregiver Internal Revenue Code Simplified

Know what youre required to pay.

. Learn about how to file nanny taxes whether youre the nanny or the employer with this step-by-step guide. If you earn 2400 or more during the calendar year your employer has until January 31st of the following year to send you a Form W-2 which indicates. As a household employer under the irs code you.

This will equal the nannys gross monthly wages before federal and state taxes are withheld. You must provide your nanny with a Form W-2 by the end of January each year so they can use it to file their tax return. As your nannys employer youre expected to pay your portion of Social Security and Medicare taxes which is 765 of his or her gross wages 62 goes to Social Security.

The Nanny Tax Company has moved. As your nannys employer you need a federal Employer Identification Number EIN. If youre a nanny or other worker who cares for others children in their employers home and you have specific job duties assigned to you the.

The Social Security Administration. Best Online Brokerage for Stock Trading Best. Instead of withholding the.

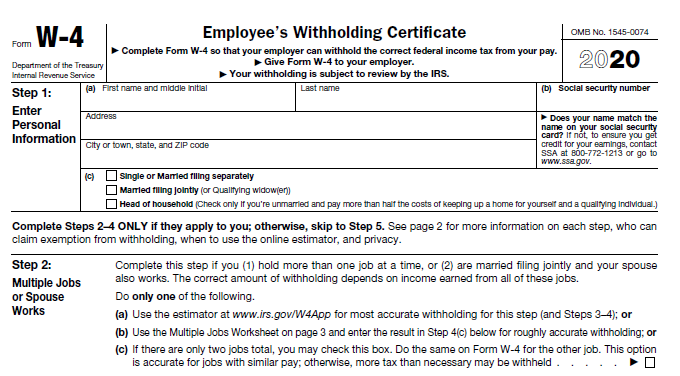

Get an EIN and Fill Out an I-9 a W-4 and a State Withholding Form. Taxes for household employees. This income is basically from.

Complete year-end tax forms. NEW YORK MainStreet If you hire a regular childcare provider you may owe the nanny tax. Can I Give My Nanny A W.

If you are being paid as independent contractor you are considered self-employed. Nanny taxes can be defined as The employment taxes to be paid by the individuals who hire household workers like nannies housekeepers senior caregivers and. That means the IRS requires you to adhere to a different set of filing.

You must provide your nanny with a Form W-2 by the end of January each year so they can use it to file their tax. Or you can pay the entire 153 yourself as a bonus for the nanny so the nanny still gets a full paycheck. This form shows your wages and taxes withheld and is attached to your income tax return.

Our new address is 110R South Prospect Ave Park Ridge IL. File Copy A of Form W-2 and Form W-3 with the Social Security Administration by. Well walk you through where you can get all.

Arguably the most complicated part of the whole nanny tax process. Personal finance expert Jane Bryant Quinn has details. Prepare and distribute Form W-2 to your employees by January 31 for the previous years taxes and wages.

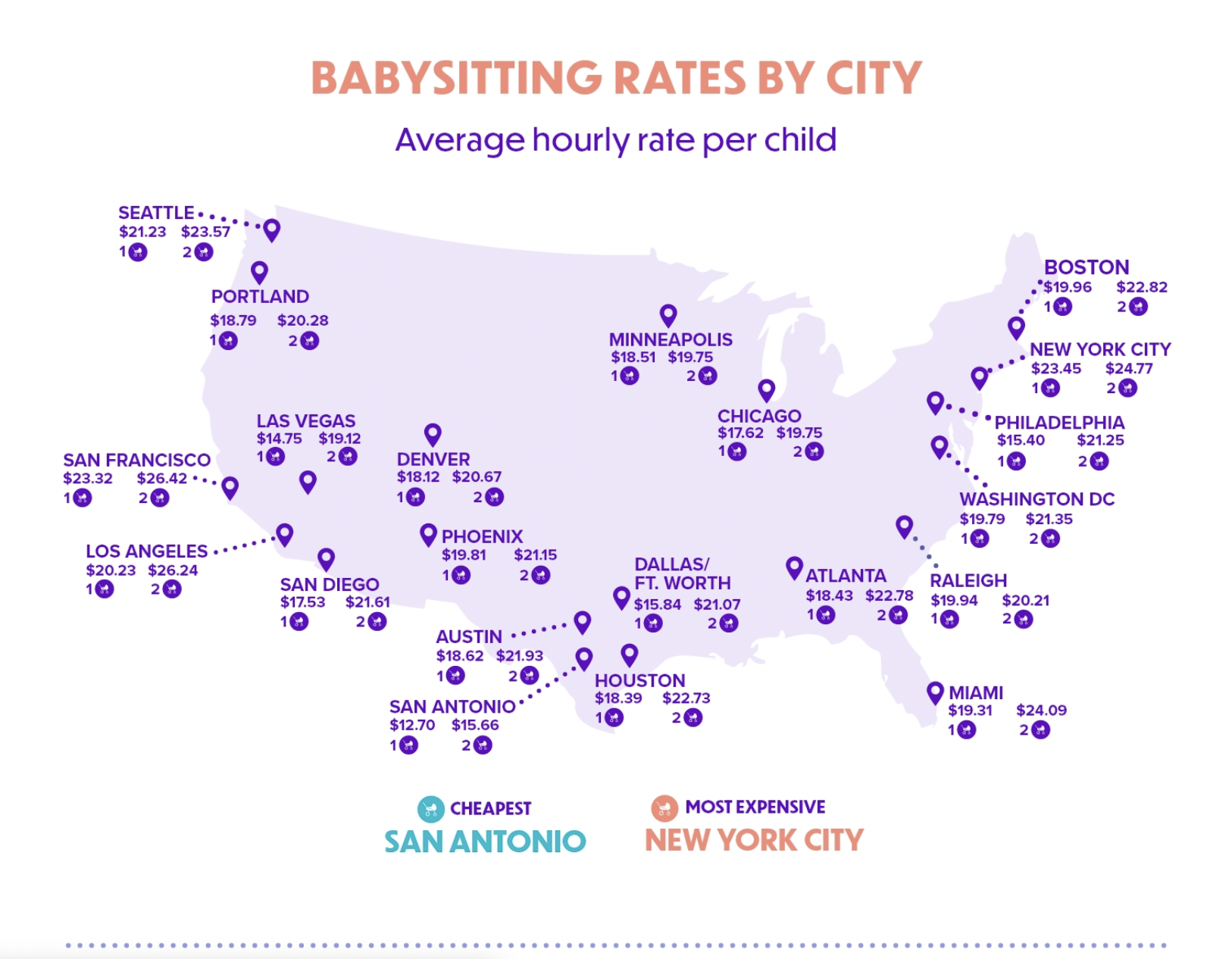

Tax Account Setup Quarterly Filings. According to the IRS babysitters do need to report their income when filing their taxes if they earned 400 or more net income for their work. If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765 percent for Social Security and Medicare taxes.

How to file taxes if youre a nanny. Get your W-2 form s by January 31. Simply divide your nannys total annual salary by 12.

If your nannys salary is.

Should I Pay My Nanny On The Books Nest Payroll

12 Things I Learned From Doing My Own Taxes Kid S Corner

Nanny Taxes Guide How To Easily File For 2021 2022 Sittercity

Hiring Grandma To Be A Nanny Robergtaxsolutions Com

Guide To The Nanny Tax For Babysitters And Employers Turbotax Tax Tips Videos

The Abcs Of Household Payroll Nanny Taxes

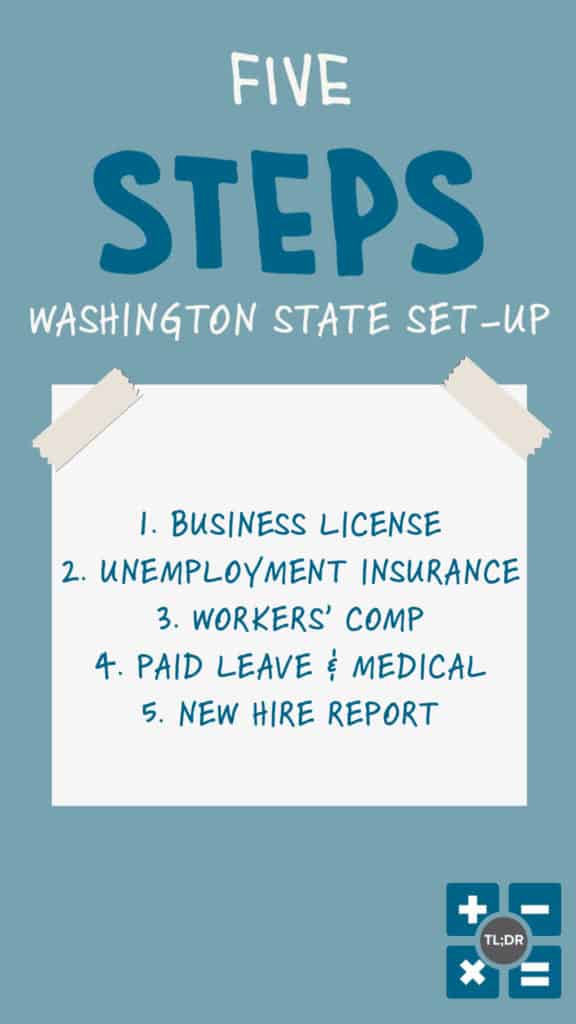

Seattle Nanny Tax Expert Faq Starling Agency Nanny Placement

The Differences Between A Nanny And A Babysitter

Nanny Tax Do I Have To Pay It Credit Karma

Everything You Need To Know About How To Pay A Nanny In 2022

Filing 2020 Nanny Taxes Us Nanny Association

Nanny Taxes Guide How To Easily File For 2021 2022 Sittercity

Nanny Taxes Explained Tl Dr Accounting

Answers To The End Of Year Tax Questions From Nannies

Nanny Tax Scenarios For Nanny S And Family Caregivers

Do You Owe The Babysitter Tax Nannypay